Allfunds operates an open architecture platform which provides a marketplace connecting financial institutions wanting to buy and/or distribute funds – either for their own account, for products they manage (including funds of funds or pension funds) or on behalf of their clients – (all these entities referred to together as Distributors) with asset managers that launch, manage or distribute such funds (referred to as Fund Houses).

Allfunds believes that its competitive strengths have allowed it to be at the forefront of innovation and to take full advantage of favorable market trends, evolving from Allfunds 1.0, a European platform with limited service offering, to Allfunds 2.0 a one-stop shop. The group believes it is well positioned to enhance its business and increase scale over the coming years, with opportunities mostly centering on the following strategic pillars supporting the Allfunds 3.0 vision for the future as a fully digital client service provider.

€1.5 tr

Patrimonio amministrato67%

Adj. EBITDA margin€632 m

Net revenues€238 m

Normalised Free Cash-Flow1,074

Dipendenti66

PaesiTutti i dati sono aggiornati al 31/12/2024

Sustained market share gain

Continued market share gain and perpetuating the flywheel effect. Allfunds has a proven record in developing business activities in its existing markets and outside its core markets, successfully growing international market share.Expansion of digital subscription-based business

Allfunds’ digital value-added proposition is a key pillar of its strategy to build a fully integrated, one-stop shop B2B wealth management marketplace.Perpetuating the flywheel effect

Complemented by the Allfunds flywheel effect, the number of Fund Houses increases, so does the value of Allfunds’ platform proposition to Distributors, and vice versa.Margin Resilience

Prime positioned to compensate margin fee pressure given the global scale and reach, strong relationships with both Distributors and Fund Houses in addition to its independence give Allfunds the ability to negotiate prices.Operating efficiencies via scale

Thanks to its scalable platform, and the continued investments to improve it, Allfunds is able to onboard new Distributors at very low marginal costs.Focus on M&A

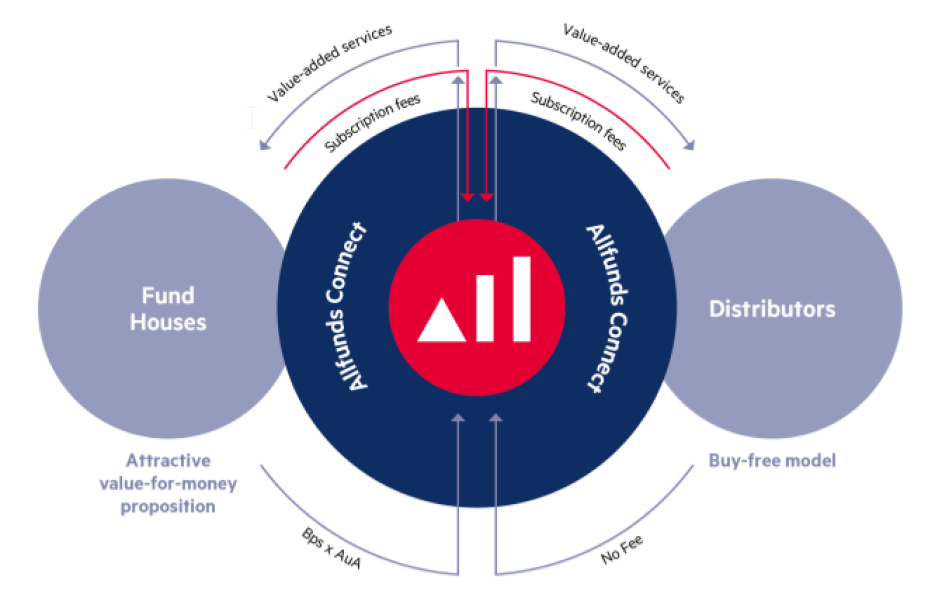

Proven M&A capabilities with a demonstrable track record of successful acquisitions have helped accelerate growth and platform enhancement.Allfunds operates within the wealth management value chain. Underpinning the value proposition of the Allfunds Platform is Allfunds Connect, a SaaS-enabled, subscription-based portal through which Distributors and Fund Houses have access to a variety of modular digital tools. This integrated, one-stop shop ecosystem provides Allfunds with a competitive advantage over other market participants, who typically only provide a sub-set of services available on the Allfunds Platform.

Allfunds believes that it has a simple and attractive business model. Distributors benefit from a buy-free model of core services related to trading, dealing, custody, settlement and administration while paying for other value-added services. Fund Houses benefit from an attractive value-for-money proposition in which they pay a fee to Allfunds for the intermediated and distributed AuA plus other value-added services.