Sustainability Navigator

How Sustainable is Your Portfolio?

Sustainability Navigator is one stop-shop to check, build and automate the calculation of sustainability features and reporting for Art.8 and Art.9 SFDR funds.

It is the ultimate platform solution crafted by our ESG expert team, backed by over 15 years of industry experience.

Launch or reclassify an art. 8 or 9 fund

Effortlessly launch or upgrade your funds to Art. 8 or 9 status with our intuitive platform.

Transform ESG and Sustainability analysis into an in-depth report

Generate comprehensive ESG reports that deliver actionable insights for your portfolios.

Gain key insights for existing art. 8 or 9 funds

Analyze your current funds for critical insights that can enhance your sustainable investment strategy.

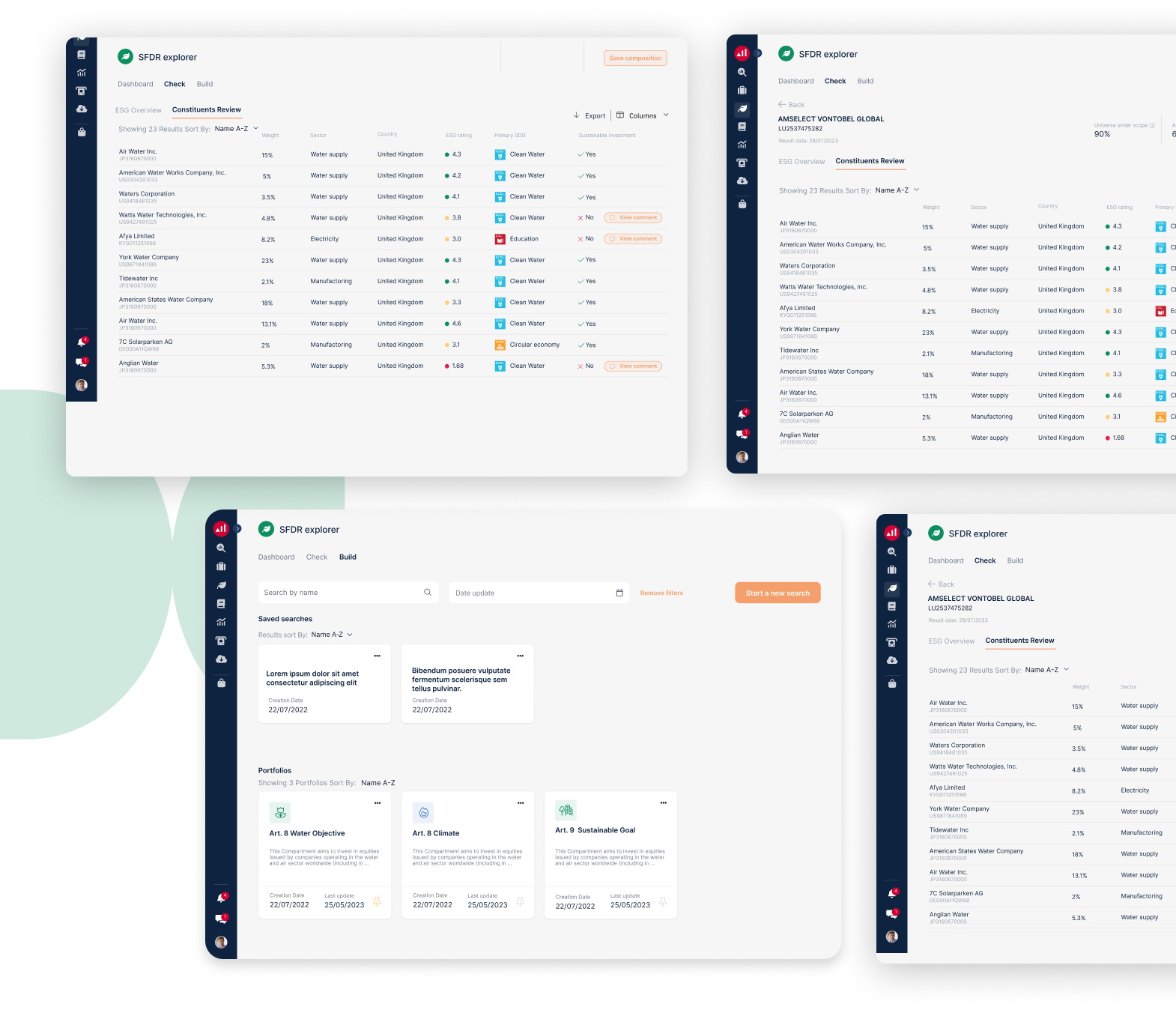

Build

Build your Sustainable Investment Universe or Portfolio

Build from scratch using an exclusive SFDR framework designed by our ESG expert team aligned with the regulation.

1

Define

Define your sustainable strategy following a SFDR framework.

2

Create

Develop a sustainable fund portfolio that meets your specific objectives.

3

Analyse

Gain actionable insights that optimize your fund’s sustainable features.

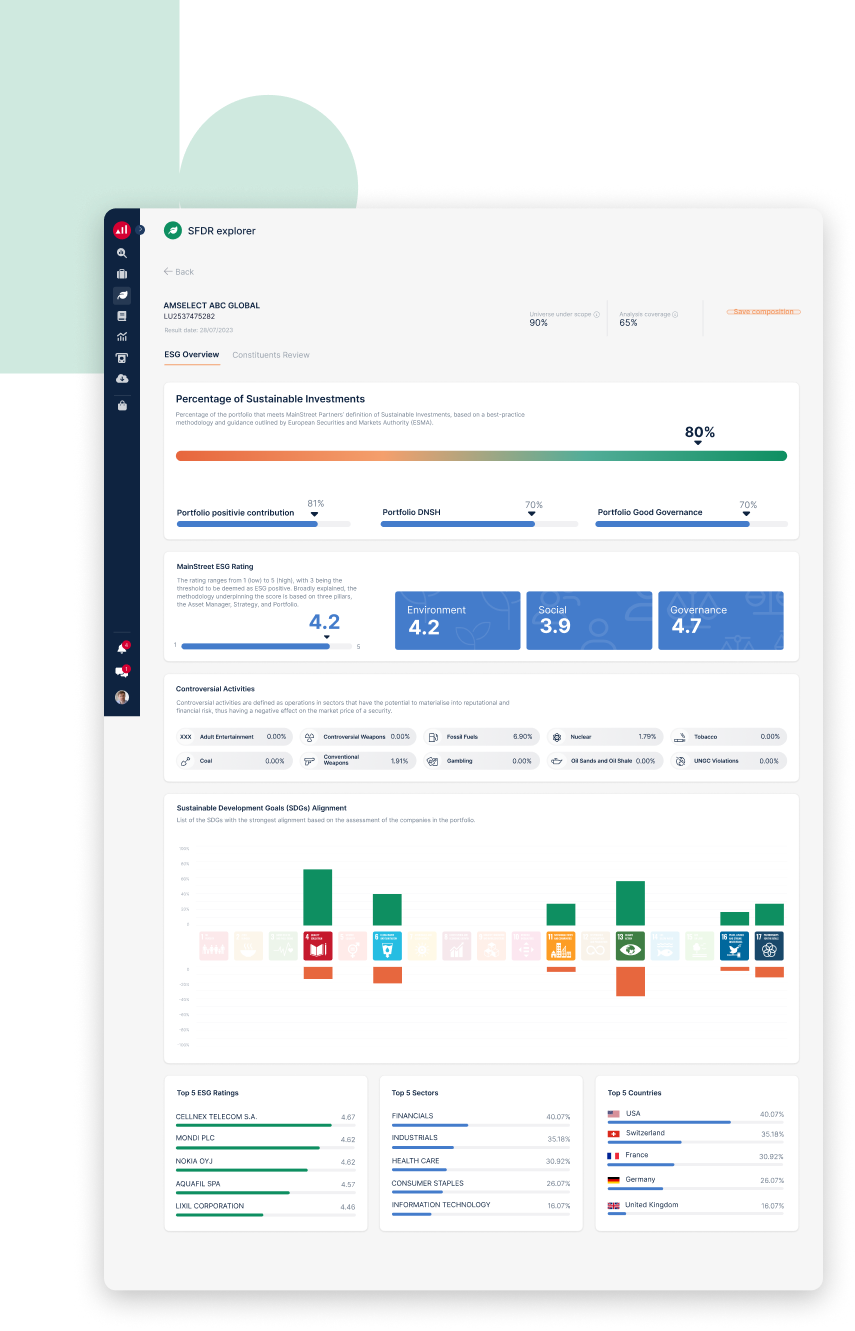

Check

Check Key Sustainable Insights of Your Portfolio

Check the portfolio of an existing fund or simulate a portfolio. Using an exclusive SFDR framework designed by our ESG expert team aligned with the regulation.

1

Upload your portfolio

Upload your portfolio composition in one click.

2

One-Click Analysis

Check main sustainable features in seconds.

Sustainable Report

Sustainability Assessment Report

Support your sustainable strategy and selection with an in-depth analysis